ASX Investor Newsletter

You may know I was included in the September edition of the ASX Investor Newsletter – you can read more here. It was all fairly basic stuff but might be worth a read for you.

Common Fallacy

I was sitting around with a group of fellow golfers on Wednesday morning (waiting for the torrential rain to clear) and one of them brought up the topic of the market and ‘timing the market’ vs ‘time in the market’. I was asked my opinion and I responded with what I believe is a common fallacy.

Numerous articles and images of indices demonstrate that over time, markets always go up. Markets are higher than what they were 20, 30 and 50 years ago. The problem is what they use to measure the market – obviously it is the general market index. However what is often lost is that the constituents of every index changes over time.

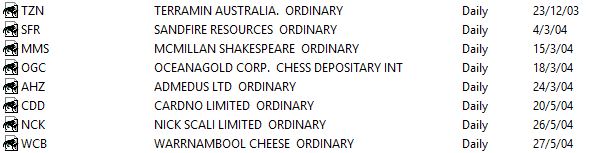

As an example, I have flicked through the 500 stocks in Australia’s All Ordinaries Index (XAO) and sorted them by listed / first traded date. I scrolled through to half way and found those companies were listed in 2003 / 04. You can see a screen shot below.

What this means is that 13 years ago, half of the companies within the XAO didn’t exist. What does that say of the 250 odd stocks whom they replaced? Where are they now?

So yes, markets (the main market index) go up over time however not every stock does.

ASX200

The ASX 200 has rallied a little to close the week after strong falls earlier. In doing so it has moved further away from the key level at 5400 which is likely to provide some measure of resistance should the index rally higher.

The new highs / lows scan was a little more even this week as there were 7 stocks in the top 500 that achieved new all time highs this week, with 2 at new all time lows.

Image from MetaStock

AUD/USD

The 0.7650 level remains key for the Australian dollar however the rounder number of 0.7500 is becoming more relevant. The AUS/USD has fallen sharply in the last two weeks and bounced off 0.7500 once but more recently pushed a little lower to a six week low below 0.7450, before the recent rally.

Over the last few months the AUD/USD has traded mainly between 0.7500 and 0.7750 and therefore established a trading range which will have observers watching for which side breaks and where the next big move will be.

I stand by my previous comments that I see limited upside as the resistance around 0.7750 seems clear and earlier last week the AUD/USD rallied strongly but was sold off just as strongly from above 0.77.

As I type this it is trading right around the key level of 0.7500 at 0.7510.

Articles